- Market buzz from investors, Oracle, institutions, and reviewer.

- Sales growth for nFusz backed by motivated Oracle sales reps.

- Oracle needs category killer to boost cloud sales.

- Earnings model shows nFusz as a value play.

- CRM market represents high growth potential for Oracle and nFusz.

Oracle NetSuite (ORCL) and nFusz Inc. (FUSZ) and have finally announced a formal partnership for the widely anticipated rollout of the integration of nFusz’s notifiCRM, the first interactive video-based CRM, into the NetSuite platform. The last week of April FUSZ exhibited at the Oracle NetSuite SuiteWorld 2018 conference then paused to exhibit at the Marketing Nation Summit hosted by Marketo a couple days later, where they announced the integration of version 2.0 of notifiCRM into the Marketo marketing platform as well. The nFusz product seemed to take center stage at both shows according to a variety of stakeholders. This new product launch has generated extreme buzz backed by the ORCL NetSuite sales force and top level executives. With such a large sales force promoting notifiCRM, FUSZ is likely to see exponential sales and earnings growth in 2018 and ORCL NetSuite should see firmness in their cloud based sales which could lead to a beat on numbers. The key for ORCL is that this new product drives sales in two ways. The first way is that ORCL sales reps are using this interactive video marketing to increase their own sales and those results should trickle to the bottom line in the next quarterly report. Secondly, when ORCL reps market to their customer base using this tool they inadvertently showcase the product which will lead to a follow on sale. It’s a one two punch that is a win for both ORCL and FUSZ.

Positive show reactions at NetSuite’s SuiteWorld Conference and Marketo’s Market Nation Summit.

After interviewing various investors that attended the show and looking at twitter feeds, investor sentiment is clearly positive. Pictures do tell the story at NetSuite SuiteWorld 2018. Most of the Oracle NetSuite sales reps saw the newly integrated notifiCRM application in NetSuite for the first time and were very excited to sell it to their customers. NetSuite is going to be the first large scale adopter of notifiCRM and notifiID because it’s free for them to use. notifiID is an interactive personalized video that launches from an icon in your email signatures, much like the LinkedIn icons many people add to their email signatures. Besides the investors the senior executives from NetSuite demo’ed the product and announced at the show they were launching their own direct sales team. They were looking for a product that could help them sell. CEO Rory Cutaia made a video of the interaction and said “they were all over this.” Numerous investors that watched FUSZ give the demo to the Oracle NetSuite executives said they were blown away. This was the first time that many of the Oracle NetSuite executives could see notifiCRM on their own platform fully integrated. The integration department signed-off on it only 2 days before the show started. The consensus was that notifiCRM was the hottest product of the show.

Oracle Senior Executives Demoing the nFusz Integration of notifiCRM

Positive Endorsement on Horizon Could Bolster Product Launch

Rich Bohn, credited as one of the oldest living independent CRM analysts had very positive comments about NetSuite and the NotifiCRM integration of Version 2.0. Investor’s might want to stay tuned as he has promised his comprehensive review shortly. Based on the success of the tradeshow, FUSZ might get a market moving mention. In February, he categorized notifiCRM as a “game changer.” If you follow Richard over his 25 year career, he has never used this strong language on any product.

|

Post Show Analysis – Next Evolution of CRM

During the show, the buzz factor meter moved from “Cool you have interactive videos” to “you have to see this technology.” Investors doing their due diligence on this technology should take a high level look at the baseline for ads you see today. Every ad you see today showcases a product and paints a picture of how cool it is and if you can remember it, then you should consider buying it. Interactive Video marketing takes ads to a new level. The days of trying to remember an ad are over. The interactive video ads say “if you like it, click here to buy it, if you have questions there are answers for you right now and it’s completely seamless and without friction.” This is the technology that FUSZ boasts has a 600% increase in conversion rates. CEO Cutaia said in a shareholder video “notifiCRM’s Version 2 mail campaign template creator will blow away Mail Chimp it’s so next generation.” Version 2.0 also has machine learning capability to drive its new A.I. marketing and sales automation capabilities. For NetSuite users, this A.I. is a competitive advantage. Oracle NetSuite sales reps will be quick to pick up on this competitive advantage. The other takeaway that came from the Oracle NetSuite sales reps was that the cost of this software is so inexpensive that the heads of marketing don’t even have to ask permission to get it because it’s well within their discretionary budgets. This software is going to be easy to sell allowing reps to make a lot of money in the process. While reaching out to their customers through notifiID, reps will indirectly be selling the software. Many investors get the feeling that the rate of adoption of this app will be exponential given its favorable relationship within ORCL NetSuite and if it does take root, that it will be the beginning of the next evolution of CRM.

Marketo Marketing Nation Summit Validates Enthusiastic Oracle Launch

Marketo is all about delivering marketing solutions to companies through its Launch Point platform. In 2016 they went private as part of a $1.79 Billion acquisition by Vista Equity Partners. They offer an “a la carte” menu of programs from which the customer can pick and choose to customize their marketing solution and all the programs are fully integrated in the platform and work together.

Marketing Nation Summit sponsored by Marketo was timed right after the Oracle NetSuite conference. One of the key takeaways from the summit was talked about in the Demand Gen report where they highlighted the importance of building a “strong data foundation to better understand the customer’s needs.” Justin Gray, CEO of LeadMD said “the more concise and targeted you can make it, the more likely you’ll be able to get buy in and streamline the ABM pilot process.” This takeaway is one of the reasons why FUSZ was one of the most popular booths at this show. Video increases the response rate and all that interactive video data funnels back to get analyzed identifying where the sweet spots are to continue the marketing drip on the customer in a targeted manner. On April 30 before the show, Marketo also announced a collaboration with Google Cloud to drive artificial intelligence innovation. The significance is that A.I. is driven by data and lots of it. The top 3 are Oracle, Google (GOOG), and Microsoft (MSFT). For FUSZ this means having access two of the top 3 A.I. databases. It’s only a matter of time until FUSZ is able to land MSFT and its Azure Cloud.

Oracles New Category Killer

Oracle’s database business has been very stagnant while cloud services were booming. This shift is what prompted the acquisition of NetSuite for $9.3 billion in 2016. ORCL management is making a shift toward cloud and cloud services. The current business segments are:

- Cloud Software as a Service (SaaS)

- Platform as a Service (PaaS)

- On Premises Software

- Hardware

- Services

As this graphic shows the only thing growing at ORCL is SaaS. If there is going to be a turnaround at ORCL is only make sense that it would start here. The turnaround could come from explosive growth of a killer app like FUSZ’s notifiCRM or an acquisition. ORCL hasn’t done many acquisitions the most recent was Zenedge. In February 2018, ORCL bought Zenedge, which provides Oracle’s Cloud Infrastructure with an integrated next-gen Web Application Firewall (WAF) and distributed Denial of Service (DDoS) capability. Zenedge has over 800,000 web properties and networks globally. It seems the core reason for this acquisition was the customer base. The piece of the puzzle fits if NetSuite sales reps start pushing notifiCRM to this newly acquired customer base as well as their own using notifiCRM as the primary sales tool. All the elements are in place for a big beat in ORCL’s SaaS category as a killer sales and marketing tool converge with many new leads to sell to.

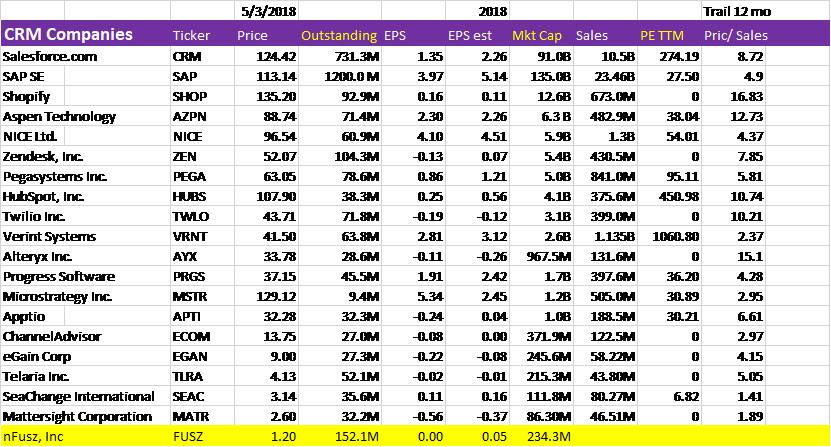

CRM Market

Grandview research put out a report that the global customer relationship management (CRM) market could reach $81.9 billion by 2025. With that growth has come exploding multiples. Morningstar’s industry average Price/Earnings multiple for the CRM industry is 107.4. The industry average Price/Sales multiple is 6.7. The industry leader is Salesforce.com (CRM) with a 768.4 P/E ratio and a Price/Sales multiple of 9.2. With these lofty multiples, sustaining the sales growth trajectory is the key ingredient. As investors can see many CRM’s are all making money and growing fast. The question for investors is what multiple do you place on an entrant to the CRM space with incredible growth potential.

CRM Players in Acquisition Mode

Many customer relationship management type companies are growing organically and through acquisition. One recent key acquisition by industry leader Salesforce.com has set the bar for acquisition pretty high. Salesforce.com snapped up MuleSoft (MULE) which had very little sales and went for a purchase price of 22 times trailing sales or $6.5 billion. Revenues of MULE were $296.5 million and on the recent conference call, the company did say that it was on track to reach $1 billion in revenue in 2021, for around a 35%-plus CAGR. That was why MuleSoft was already selling for as high a sales multiple as it was prior to the acquisition.

nFusz technology

The nFusz technology is built on millions of lines of proprietary code. It is also has a proprietary video storage solution that reduces costs dramatically and increases margins, allowing nFusz to offer the product at pricing that is more competitive than any other CRM/sales tool on the market.

Management history of success

Success and disruption is part of the DNA at FUSZ. The CEO, Rory J. Cutaia, has a successful track record. He was the founder and CEO of The Telx Group Inc., where he disrupted the entire telecom sector when he created co-location and the carrier meet-me-room business model allowing telecom carriers to interconnect with one another more efficiently and effectively. It’s still the de facto standard by which all telecom carriers interconnect today. Initial investors were able to achieve an 18x return on their investment. It was sold for over $200 million in 2006. In October 2015, Digital Realty purchased Telx for $1.9 billion underscoring the strong foundation and viability of his company. It’s a fixed cost, recurring revenue model, similar to FUSZ. Also part of senior management is CFO Jeff Clayborne, who after years at Walt Disney as the Global Senior Finance Manager, and then Universal Music Group as the Head of Finance and business development, he joined Mr. Cutaia at nFusz. He too has the entrepreneurial spirit.

If history serves as a guide, then management’s current mission is to disrupt the CRM space. At the MicroCap Conference on April 9th, CEO Rory J. Cutaia said “the current CRM products do an excellent job tracking customer engagement, but they do nothing to create customer engagement, and that’s what salespeople and marketing professionals need today. It’s not just about tracking existing customers, it’s also necessary to attract new customers. nFusz’ notifiCRM does all that and more using the power of interactive video technology. With our technology, we have eliminated friction from the sales process.” Approximately 80% of prospects are lost if the prospect has to leave the video to contact the company. Making a sales contact while still in the video has increased sales conversion rates by 600%. Rory went on to comment “The system leverages everyone’s propensity to impulse buy. Amazon figured this out early on when they created one-click buy capability. Now all nFusz clients can leverage this powerful sales tool in notifiCRM’s interactive sales and marketing videos.”

Buyout Could Come Sooner Versus Later

Traditionally a joint product announcement would precede a tradeshow. The fact that there hasn’t been an official announcement led to speculation that there were problems with the integration but it has also given rise to speculation that ORCL was seriously considering an outright purchase of the company. At the NetSuite conference the attendees included Salesforce.com (CRM), Amazon (AMZN) and SAP(SAP). This isn’t well publicized that large competitors use ORCL’s enterprise software but it’s a must for them. A lot of eyes will be watching both the rollout of notifiCRM on NetSuite and Marketo. As the company gains traction and sales ramp up suitors are likely to approach FUSZ with joint venture proposals or an acquisition.

Earnings Model – Overly Conservative

The NetSuite earnings model for FUSZ that was compiled while writing this article assumes just 2000 of the NetSuite worldwide salesforce compared to the approximately 35,000 member sales team of the parent company ORCL. 90% of the revenue flows to FUSZ and the retail cost to NetSuite users is a $99 monthly fee and $10/month endpoint fee. Adoption grows from .5 sales per month/rep to .6 sales per month/rep over 8 months and the average size of the sale stays constant at 25 users. These sales numbers equate to $5,600 in commission sales per NetSuite Sales Rep over the 8 months. To illustrate how conservative these revenue number are Business Insider published “Even the mediocre performers selling enterprise license software are going to be making in the $300,000-$350,000 range where top performers are going to make $400,000-$600,000.” With reps earning an average of 30% commissions on SaaS sales these sales number would represent $1,680 or .5% of their overall annual commission. According to investors at the show, this was the number one thing Oracle Sales reps were buzzing about.

Earnings Model – Endpoint Specific

I prepared a valuation model for nFusz based on the ORCL opportunity alone with millions of endpoints in a total available market, to try to evaluate how earnings could scale based on endpoint growth and expansion to all ORCL sales reps. An endpoint is essentially a user that can logon to the NetSuite platform and access it from their desktop, mobile, or tablet. This model assumes full dilution of the company at 200 million shares authorized and ZERO revenue from setup which would allow their channel partners to slash pricing to get traction. The current P/E of the average CRM company is 117, but the assumption lay out different P/E multiples. In the first year, my conservative estimates put the number of endpoints at 4.0 million, therefore it is highlighted.

Future Catalysts for FUSZ

There are so many catalysts in the pipeline, FUSZ resembles an advertising platform rather than an SaaS company. FUSZ has a rich social media profile that constantly updates investors over twitter and through their SHAC messages. In these video reports are the future catalysts.

- School Districts – Recent announcement of notifiTeach – bringing interactive video based learning to school districts.

- UBid Auction Site – Labeled by Cutaia as an “enormous opportunity” incorporating technology that will change the online auction industry by reaching out to people with interactive video based auctions instead of waiting for them to come to your website.

- Entourage Network Marketing – Large network marketing influencers are using the platform and pushing it up to corporate.

- Integrations into other large CRM providers

- Recent rumblings about notifiHEALTH

- Restructured ORU roll-out

Great Deal for Oracle Even Better for FUSZ

Oracle’s sales force gets to use the software for free. As they learn to use it and improve their results they should be able recommend it to their existing customer base. At the trade show there were reports that ORCL execs were sending their sales reps to demo the technology at the booth. ORCL really wanted this technology because executives saw that it creates such value it might drive NetSuite sales. There is an old saying “What’s good for the goose is good for the gander.” That means that ORCL gets a 10% commission for selling notifiCRM but conversely FUSZ gets a 10% commission on bringing in a new NetSuite customer. Let’s put this into perspective. For example, if the FUSZ sales force lands a big client like a network marketing company such as Isagenix with millions of sales reps worldwide and gets them on the NetSuite platform, ORCL will pay 10% monthly residual which could be upwards of $100,000 /month assuming a $1.0 million /month contract. In addition, FUSZ would have the millions of endpoints paying $10/month for notifiCRM. The thought is that once enterprise customers choose an ERP software it becomes a long term proposition because migration is so costly. The number one reason that this is an incredible deal for FUSZ is the customer acquisition cost. ORCL’s sales force is selling notifiCRM to their existing NetSuite customers as an add-on. This is a brilliant move. This saves FUSZ from having to raise millions of dollars and avoid any dilution to build out and manage a sales force.

Investment Summary

The momentum from the NetSuite Conference and the Marketo Conference are clearly positive catalysts for the stocks of FUSZ and ORCL. ORCL’s internal adoption of the notifiCRM platform is a key win for FUSZ but could lead to much better than expected revenues for ORCL in the coming quarter if sales reps get just 1/6th of the conversion rate that FUSZ has boasted. ORCL seems to have an overall strategy that relies on SaaS to push it’s next pillar of growth and help reignite is core ERP solutions. FUSZ seems to be a catalyst because notifiCRM gets to leverage ORCL’s sales experience and A.I. database from NetSuite users that opt to add notifiCRM to their NetSuite bundle.

FUSZ negotiated a great deal with ORCL whereby it gets to keep 90% of the revenue from sales by Oracle NetSuite reps to their own clients and nFusz doesn’t have to bear the risk of building out a sales team. My projected earnings model is very conservative. A true sense of the sales traction will come once Q2 earnings are released and therein lies the biggest risk to investors. The company has many different verticals and the prospects of a big direct sale are high especially with the entourage product targeted to network marketing companies. There is a seasoned management team that knows how to develop a killer app and promote it. Normally management is binary whereby they are tech savvy or sales savvy but FUSZ seems to have a perfect blend of both. The company balance sheet is strong and getting stronger which will eventually lead to an uplisting and further price appreciation. Insider buying and large buying from existing shareholders underpins the investment. On a valuation basis the stock trades at a multiple of 1.75 X projected 2018 earnings per share while its peers trade at an average multiple of 104 in the CRM field. Given very conservative sales growth the short term price target on FUSZ stock is $7.50.

Disclosure: PSInvestor has NOT been compensated for the above article, but currently hold a LONG position bought on the open market in which we MAY trade in and out of in the near future. To read our full disclaimer, please click here.