– CreateApp is the new wordpress of Indonesia

– Indonesia is the 4th largest world market with an emerging mobile economy

– CreateApp sales reach and Inflection point

– Low downside risk in light of extremely attractive valuation

– Earning beat and guidance rise.

Weyland Technologies Inc. (WEYL) is a riding a wave of tsunami proportions effecting the Indonesian market. Demographics and connectivity are responsible for the growth. Indonesia is located in Southeast Asia and is made up of many volcanic islands. Their population is estimated to be 262.8 million and ranked the 4th most populous country in the world behind the United States with 329.3 million. With the advent of 4G coverage has really exploded and connected this people in a way they have never seen before. People who have never known the internet or what it is get it with their smart phones. The younger demographic which is technology savvy wants to use and they want to buy things. The more mature demographic also wants to buy things and use it as a business tool. WEYL announced earning on November 14, 2018 and beat revenue expectation by a huge margin coming with $8.3 million for the quarter and was able to generate 87% gross margins. WEYL has two subsidiaries that cuts to the heart of each of these demographics needs.

CreateApp is the WordPress of the Indonesian Market

For the millions of Indonesians, the first time they are getting connected to the internet is from their smart phone. This is going to be their first and only internet connected device which means that apps are going to play a key role in defining their usage. CreateApp allows small to medium size business to create their own virtual stores on an app on their phone. Instead of hiring a website or app builder they can download this DIY app and build it themselves. Then the app they build gives them the presence they need in the mobile economy to sell or display their goods online. This is app is equivalent to the WordPress for the Indonesian market, but it is clearly disruptive in nature and without any geographical bounds could easily spread to developed countries where small business are looking for a cost effective way to build an app. The analogy to WordPress should resonate to investors in the sense that CreateApp is becoming the preferred platform for small business content development. Think about how big this market is in the USA and then discount it a little based on population to the Indonesian market. What is owning that market worth? This is a landgrab and the company is the leader in the space.

The interesting thing about CreateApp is that it is a Platform as a Service (PaaS) which means that it has no geographical boundaries and can be implemented anywhere in the world. The company has “white labeled” to quite a few foreign countries which include Malaysia, Hong Kong, Thailand, The Philippines, and France.

AtoZPay Coverage Area with Telkomsel

AtoZPay Solving Banking Problem in Indonesia

If technology can solve a real world problem there is an opportunity to make a lot of money in the process. WEYL has a minority 35% interest in AtoZpay which is a payment platform for cell phones. It made a special dividend of 90% of its former 49% ownership of the company but it retained essentially 5% plus it has an additional option to purchase 30% of the company for a nominal fee. What AtoZPay has done is take the cell phones “top up” capability and turn it into the new banking system. Many in Indonesia had prepaid phones where they went into a store to buy credits and are familiar with the process. It’s the same process of going into the convenience store and then they load funds onto your phone. The difference with AtoZpay are the relationships that they have and the flexibility of the platform. They can load money on their phone at their local convenience store and then they can pay for something online or they can travel to another island go to the ATM and withdraw cash. Their phone becomes the payment gateway. AtoZPay has relationships with the utilities and allows users to pay via their phone. There is a small transaction fee to get the cash in the system but it has not been a barrier to entry.

AtoZPay Partners

1 Telkomsel – Largest telecom service provider

2 BRI Bank – Oldest bank in Indonesia with US$62 billion in assets

3 Bank Mandiri – Largest bank in Indonesia with US$81 billion in assets

4 GrabTaxi – Number one ride sharing and delivery service in SE Asia – Funded by HSBC, Toyota Motor, Oppenheimer, Softbank

5 Go-Jek – Largest Motorcycle and scooter based taxi service – Funded by Google, Tencent, Temasek, Sequia Capital, KKR

The company is literally spreading like a virus and going from island to island with marketing groups that take over the local atmosphere and educate and train people on the new way to bank and get access to all the online goodies the internet has to offer. Getting to the consumer first is the key to this market and if they can do it profitably even better. The company has spent a lot of money on people to get the message out and consumers are very receptive. They are in the right spot at the right time because people want a banking solution. Building banks on each of these tiny islands with the infrastructure just isn’t efficient. There is a better way and its called AtoZPay.

Earnings Beat and Inflection Point

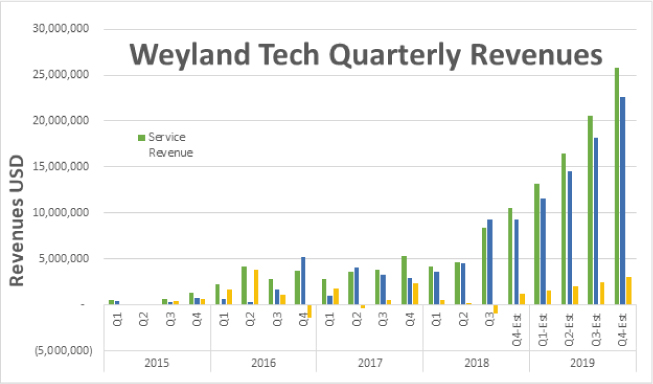

The service revenues for the third Quarter were $8,436,412 which represents a 45% increase over the $4,658,980 quarter over quarter. Driving the record quarterly sales was a massive promotional effort with white label partners along with the enhancements from the release of Version 3. The company increased its sales performance incentives in order to get traction with its launch of Version 3. Most of the input for Version 3 came from feedback from customers looking for functional enhancements. These enhancements included the completion of the DPEX enabled dashboard as well as integrating the AtoZPay into the CreateApp platform. Having this built-in ubiquitous payment platform seemed to be a major selling point. A key milestone is that they were able to expand sales while increasing the price of the service.

Profitability suffered during the quarter as they spent as much as they made, but a majority of the costs were from the R&D which has doubled quarter over quarter for the past 3 quarters. With the launch of Version 3 behind them its seems unlikely that R&D levels will stay this high which means they could be profitable as soon as next quarter or show another 40% increase in sales Quarter over Quarter (QOQ). The marketing was highly successful and for the past 3 quarters has been running at a predictable 45% of sales. The onboarding of so many clients in the quarter is also going to result in a handsome recurring revenue stream. CreateApp essentially becomes the Small to Medium Business (SMB) hosting provider and AtoZPay becomes there merchant account. Business essentials like a merchant account and website are universal needs and CreateApp and AtoZPay are the first to cater to this huge demographic which is just getting online.

Based on existing trends we are upgrading revenue estimates to $10.5 million for the fourth quarter citing the seasonal demand in retail and 30% QOQ growth. R&D is expected to go down to 30% of sales and marketing expense should stay constant at 45% of sales. Profitability should come in between $1.2 – $1.5 million for the quarter and based on 36.8 million shares outstanding earnings per share should be between .03 – .04 per share. FY 2018 should be profitable but 2019 could see exponential growth. FY2019 projections are $76 million in CreateApp revenues and net income of $9.12 with EPS of $.25.

Valuation Model

The company has one wholly owned operation called CreateApp and a minority owned stake 35% stake in AtoZPay. The value of the stake in AtoZPay and Create App should equal the market capitalization of the company. With 37 million shares outstanding and a stock price of $1.50 the market cap is roughly $55.5 million. 2019 estimates of AtoZPay are $100 million in revenue and $76 million in revenue from CreateApp. Adjusting the sales to the ownership percentage in AtoZPay reveals $35 million in sales attributable to WEYL’s market cap. The combined entity would have approximately $111 million in sales and normal Software as a Service (SaaS) multiples for public companies average 6. This combined entity is worth $666 million using these established metrics. In terms of stock price the value of the shares should be $18.10.

There is one major caveat regarding the share structure. In 2015 an acquisition for 8 million shares was unwound but has remained on the shareholder ledger and will continue to do so until a settlement is reached. We feel that there is a high likelihood that 8 million shares will be returned to the treasury making the outstanding share count approximately 29 million shares that adjustments to earnings should be made. Adjusting to the proper amount of shares the current stock value comes in at $23.00.

Spinoff Drama

It’s pretty clear from the market action that there is a big short in the stock that was a consequence of at least 5.0 million shares that were issued for a deal that was rescinded. The holder of these shares is from Singapore and the theory is that he started selling these shares once he got them not realizing that the deal was going to be rescinded. In March 2018 once it became clear that there was no way the shares would be cleared the short sold the stock down for 90 days straight. In doing so he over doubled down on his position and liability. The company fought back with insider buying and then after that didn’t work came up with a strategic plan to spin off one of its assets in a non-dtcc transaction.

The purpose of the spinoff was to force a reconciliation of accounts between the major brokerage houses and DTCC. Despite discussions with regulators and brokerage houses no buyin to reconcile the books has happened. Instead the brokers didn’t comply with instructions an lost their clients an estimated 700,000 shares of dividend stock because they didn’t sent in a list of their shareholders as required by the corporate action. The brokers that did comply likely sent in lists that match up with DTCC but the only issue is how did they pick the shareholder who get the dividend company versus the ones that they are short. These brokerages have been kicking the can down the road but on November 30, 2018 the dividends will be sent out and scores of angry shareholders will be waiting to wage class action against all the major brokerages for anything from breach of fiduciary duty to securities fraud. When scores of shareholders who didn’t receive their shares call their broker it seems reasonable that the major brokers will finally call the company to work a deal to get the dividend shares. At this time WEYL could force the brokerages into a buyin situation to clear out the naked short or face the legal wrath of a class action suit from the shareholders and suit from WEYL. Anytime before November 30, 2018 regulators could step in an force the brokerage houses to buyin the stock and bring the books flat. This process would wipe out the short position for good and likely create an astronomical short squeeze in the process. The brokers have been caught taking trades from known market makers that have a history of failing to deliver. There could be a buy in at any time which is reason enough to hold the stock.

Investment Summary

The company has a great sales force and a product that sells itself. WEYL is a growth in revenue and land grab story. Once this company reaches $100 million plus in revenue they become a takeover candidate in the public or private market. The private market is averaging 15X sales for SaaS companies and payment platform in the 4 largest market in the world is going to be eyed by some big companies. Investors need to realize that in about 1 year WEYL may be above these revenue numbers. If private equity buys WEYL it could fetch $1.5 billion. Fully diluted that works out to $40/share. Investors with a one year time horizon could be looking at a 25X return. When markets are manipulated and not allowed to seek price discovery dramatic inefficiencies of the market can develop. We think this is one of those cases if not the poster child of inefficiency. On a fundamental basis WEYL stock is grossly undervalued. The stock beat earnings estimates by double yet there was a muted reaction. The company is making great strides and the synergies of AtoZPay are starting to pay off with massive adoption of the CreatApp ecosystem. The company could be profitable as soon as this coming quarter and may not need money from growth. This means that a stock buyback announcement might land the final crushing blow to the short and let the stock seek price discovery. Add to this the possibility of additional strategic alliances. Any one of WEYL’s strategic partners are so large they could likely buy WEYL anytime they want to acquire additional revenues.

Disclosure: PSInvestor has NOT been compensated for this article but does hold a LONG position. Full Disclaimer here.